Banks invariably like folks that have smart credit history, however it’s doesn’t mean that folks United Nations agency square measure scuffling with poor credit history they’ll not get loans. in an exceedingly good world, everybody would have a spare savings, however the fact is completely completely different, in line with the FISCO score sixty seven p.c of the Indians have but $1000 in their saving account and rest forty three share have $0.

We all have associate emergency that desires additional money time to time. sadly, credit score plays a significant role in our money services. Having an honest credit suggests that you’ll get a loan at a lowest rate of interest as a result of it shows that you just square measure paying your bills and debts on time each month. just in case of dangerous credit, it’s extremely probable that your loan can get rejected. All banks and establishment acknowledge your credit score before approving loan as a result of it helps the lenders to research whether or not the individual pay back their cash on time or not. If you tend to take care of dangerous credit report, then there square measure probabilities that your application could get rejected. therefore what ought to be the answer of this problem? the way to get cash with a nasty credit? Not worry concerning it, the most effective thanks to kick off from this downside is, all you wish to try and do is seek for day loans close to ME no credit check on a pursuit engine you may get to envision many choices turning out. It depends upon to decide on the most effective and therefore the most ideal choice United Nations agency will offer you warranted installment loans for dangerous credit.

Table of Contents

What is day loans and the way they work?

Payday loans square measure short term loan, high interest, usually for dangerous credit people, that’s designed to bridge the gap between paychecks. The loan quantity is granted a usually fairly tiny and supported what proportion recipient payback on every installment amount. tho’ the rate of interest is slightly on top of a alternative standard loans. generally, A day loan is that the best choice for people who don’t have access to credit cards or saving account and at identical time it drawn to individuals with no credit check downside.

Payday loans will be a wonderful tool for quickly and simply borrowing money throughout associate emergency time or maybe after you don’t have another money choice. Lenders can simply warranted Approval payday loans for dangerous credit in day loans as a result of the most factor lenders square measure searching for in associate somebody could be a regular flow of high interest in their checking account.

Whar square measure the advantages you get with a day loan?

In order to receive a day loan, you want to be match into the subsequent categories:

- He/she should be a minimum of eighteen years recent.

- Have a checking account.

- Must have identification documents.

Benefits of day loans:

- Applying for day loans is kind of simple, since the sole issue works in day loan you have got ne’er defaulted on another day loan within the past.

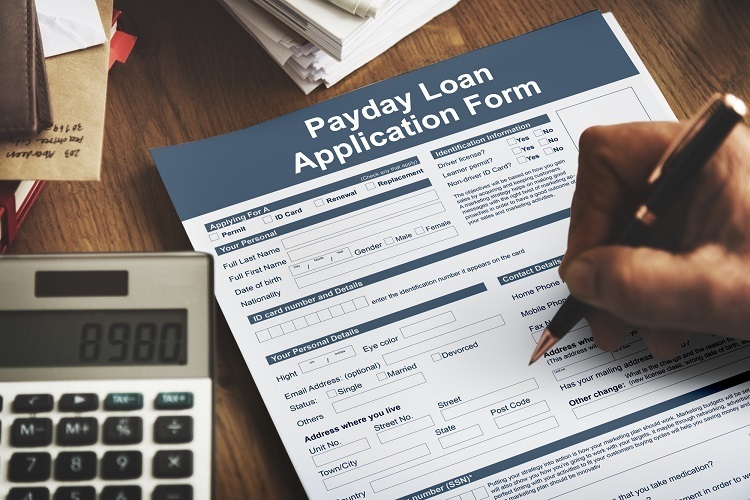

- Filling out associate form is very simple and quick. Once lenders received your type , he can lend the money among twenty four hours.

- Payday loan usually don’t have any restriction, which implies you’ll use the money as per your would like.